Some Whidbey residents will see their flood insurance premiums rise by up to 400 percent under new flood insurance rate maps released by the federal government, while others’ rates will remain flat.

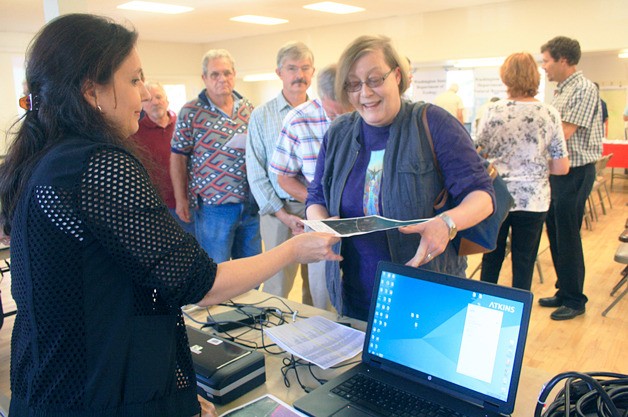

Those and other details about how the changes will impact homeowners of Whidbey’s 148 miles of coastline became clear Wednesday at a packed meeting at the Coupeville Recreation Hall. Federal, state, county and local officials were on hand to answer general questions about flooding and the federal flood insurance rate maps newly issued by the Federal Emergency Management Agency, or FEMA.

The new maps are accurate to within 1-2 feet, while the older ones were accurate only to within 5-10 feet, said FEMA engineer Ted Perkins, who addressed the crowd for nearly an hour. The new maps, issued free to any waterfront homeowner who requested one, show the elevation one would have to build at to avoid flooding during the most violent storm likely to occur within a 100-year period — a so-called 100-year flood.

Island County, in late July, sent postcards to 4,260 island residents who might be affected by the changed maps, which in general reflect higher water levels and so greater danger of flooding to more properties.

Drew Smith, who owns a summer cottage on Sunlight Beach Road in Clinton, learned his annual flood-insurance premiums will increase by 400 percent or more, to $2,000 or $2,500, from $500 — but only in increments of 15 percent per year.

“I’ll have to think about whether I continue to carry flood insurance at all,” Smith said after the meeting. “I learned that tsunami danger is minimal on the South End, so I’m not even sure I need the insurance.”

Another FEMA engineer told the group that a tsunami would most strongly affect the west side of Whidbey, starting at about Greenbank and moving northward. But flooding could also be caused by a combination of high tide, high wind and rain.

Homeowners carrying federally-backed loans are required to carry flood insurance, Perkins said. For others it is optional. The insurance can cover both a house and its contents.

Dan Weber, of Seashell Drive in Clinton, learned his property is outside the flood boundaries, though it is adjacent to the water.

“It’s a bit of a relief to know that I don’t have to deal with this in any form or fashion,” he said after the meeting.

Mark Kjellstrom, who owns property on Holmes Harbor in Greenbank, said only the toe of his bluff touches the water, while his house, 65 feet above the water, is far outside the flood zone.

“I’m grateful,” he said. “I don’t need to pay more insurance.”

No one at the meeting was able to say how many Island County homeowners will see an increase in their premiums or what the average increase will be. County Planning Director Dave Wechner said earlier this month that rates will increase for “a fair amount” of those 4,260 property owners who were notified of the changes by postcard.

Flood premiums, set by the National Flood Insurance Program, are increasing for several reasons, FEMA said. Congress phased out some flood-insurance subsidies, the number and size of flood claims are increasing, more people are living in floodplains and storms are becoming increasingly frequent and severe.

To view properties included in flood zones, see http://bit.ly/1tJh5tr. Properties coded “VE” will see a three-foot or higher breaking wave in a 100-year flood. That means structures must be built on piers and pilings, Perkins said. Properties coded “AE” may be built on standard slabs, though the elevation must be high enough above flood level to minimize damage, he said.

Waterfront homeowners without elevation certificates, which accurately state how high above the water a property lies, may need to contact a surveyor to obtain such a certificate, he said.

The new maps’ findings may be appealed if a homeowner has data showing they are inaccurate.

For details on the appeal process, see www.fema.gov/change-flood-zone-designation-online-letter-map-change.